Stoic Insights: Principles for Dealing with the Changing World Order

A break-down and discussion on market cycles, reserve currency & cycle shifts in wealth and power.

Blurb on Ray Dalio:

Ray Dalio has been a global macro investor for more than 50 years. He is the founder (now retired co-CEO) of one of the largest hedge fund firms, Bridgewater Associates (manages $124 billion), which he started out of a two-bedroom apartment in NYC. Ray has a logic based, engineering heavy philosophy to investing, problem solving and life in general.

Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail by Ray Dalio

This book is particularly dense with information (~800 pages). Bear with me, I promise you will learn something if you read through this seemingly long section. Tried to condense the information the best I could.

We will only touch upon Chapter 1- “How the World Works” in this edition of Stoic’s Corner. However, I would highly recommend you pick up the book if you have the time and hope to make the case why you should do that through the following take-aways:

1. “History Doesn’t Repeat Itself, But It Often Rhymes” – Mark Twain

Aggregate human behavior does not change. Therefore, to understand the cyclical nature of markets and macroeconomics it is vital to study history and understand the nature of this behavior.

Dalio discusses the patterns and cause/effect relationships that govern these cycles, “like that of organisms, that evolve as each generation transitions to the next”. The ability to predict the future with any kind of certainty is dependent on studying and understanding these “cause/effect relationships” that brought about changes in the past i.e. develop an understanding of the process of change through the study of how changes have occurred in the past.

The “big moments of evolution” are overlooked because people are typically caught up in the day-to-day minutia and it is fairly difficult to look at the big picture or the lay-out of the entire chessboard as it stands. “To see the big picture, you can’t focus on the details”.

In his study, Dalio found that each successful empire or dynasty goes through a cycle that lasts ~250 years (with a tolerance of +/- 150 years). He refers to this as the “Big Cycle”.

2. The Big Cycle

An analogy is to think of this cycle as a massive pendulum that slowly swings from one extreme to the other. The extremes on either end of the pendulum are prosperity & peace vs. tremendous wealth disparity, war, famine etc. The typical ratio of time spent is 5:1 between the two extremes. In other words, the amount of time spent in peace and prosperity is five times that of the time spent in belligerent chaos.

“No system of government, no economic system, no currency, and no empire lasts forever, yet almost everyone is surprised and ruined when they fail”.

One thing to note is that the two extremes come along perhaps once in a lifetime and therefore surprise the average person that has not studied these patterns.

3. Further Denomination of the Big Cycle

The three sub-cycles that occur within the Big Cycle are as follows:

1. The Long-Term Debt and Capital Markets Cycle- time period where interest rates are at an all-time low and debt is highly abundant. “In 2021, more than $16 trillion of additional new debt was at negative interest rates”.

2. The Internal Order & Disorder Cycle- wealth disparity, extreme divisiveness when it comes to values and political inequality.

3. The External Order & Disorder Cycle- Dalio points out the rivaling threat from China. China has grown in strength at an exponential rate and the US-China conflict has been smoldering & gradually increasing in intensity for quite a while specifically in the areas of “trade, technology, geopolitics, capital, and economic/political/social ideologies”.

Through his research, Dalio found the following:

Major parameters impacting people in most countries include “the struggle to make, take, and distribute wealth and power”.

Symbiotic relationship b/w people who have wealth and people who have political power i.e. people with money control the rules that are set and enforced.

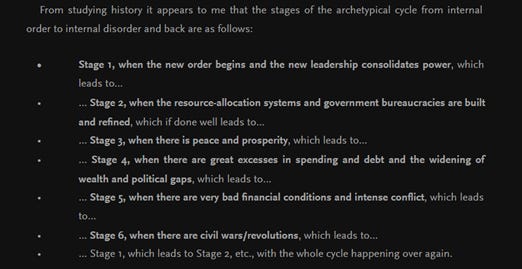

The aforementioned relationship leads to a small percentage of the population gaining control, becoming overextended, facing “bad times” which leads to the least wealthy being impacted the most, leading to civil war and revolutions. This period of conflict is followed by “a new world order” and the cycle is thus renewed.

Human productivity is the driving force of collective wealth, power, living standard trajectory of the world. As such, it is logical to assume that increase in productivity goes hand in hand with improvement in global GDP per capita & life expectancy.

Even though productivity is significant and drives growth, “step changes” in wealth and power are caused by revolutions, wars, booms etc.

The typical cycle consists of some form of “credit collapse” due to the fact there is an accumulation of debt that is insurmountable. We know the drill. The central government has to step in to spend money (that it doesn’t have) to pay off the debt and the central bank “always has to print money and liberally provide credit”. An example of this is evident not so long ago during the COVID pandemic.

“There are always arguments or fights between those who want to make big redistributions of wealth and those who don’t.”

The 1930s drawdown was a result of the roaring 20s boom that was a consequence of a debt-financed bubble that popped in 1929. Similar to now there was significant wealth disparity at the time, escalated by economic collapse which resulted in revolutionary change.

A study of a conglomerate of past cases of economic and market declines revealed a recovery period of ~3 years (+/- a few years). The nature of the period of recovery is dependent on the “debt restructuring and/or debt monetization process”.

All is not gloomy, even though these time periods of economic decline come with significant suffering – human beings are highly adaptable and societies typically re-emerge rapidly through these times with renewed and “higher levels of well-being”.

4. BIG CYCLE SHIFTS IN WEALTH & POWER

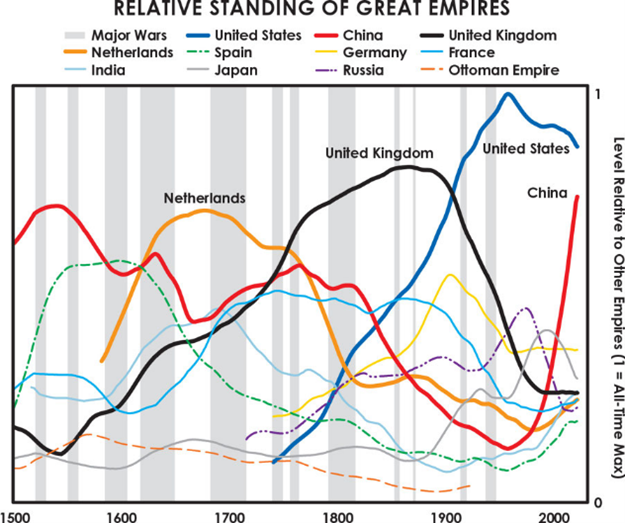

Throughout history there have been many powerful empires: namely the Dutch, the British, the American & the Chinese. The relative standing of empires is composed of eight determinate factors: education, competitiveness, innovation and technology, economic output, share of world trade, military strength, financial center strength and reserve currency status.

What’s common between the Netherlands, UK and US you might ask? The Netherlands and the United Kingdom held the last two reserve currencies. The Dutch became the world’s reserve currency empire in the 1600s, the UK followed the same path while peaking in the 1800s and the US became king “over the last 150 years, though particularly during and after World War II”.

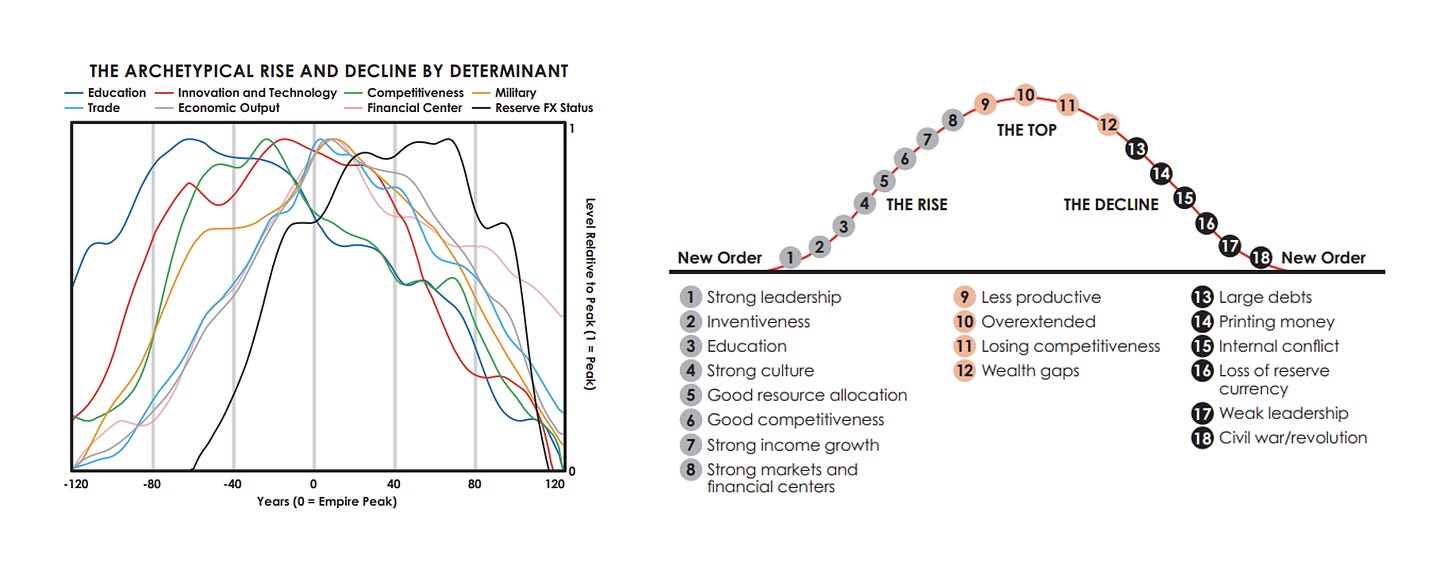

The chart on the left is a further breakdown of the eight factors that contribute to the “relative standing of great empires”. One observation of interest is the lag when it comes to the status of reserve currency (the black line). In other words, during the downward trajectory of an empire the reserve currency is the last factor to peak before a steep decline.

The descriptive chart on the right demonstrates the characteristics in each of the three phases- the rise, the top and the decline. Taking it at face value, the US is in the “13” to potentially the “15” category currently. The recent development with the BRICS (countries forming an alliance with one of the goals being the ousting of the US dollar from being a reserve currency) is currently still a pipeline dream but is a factor to keep an eye on.

Dalio goes on to lay out characteristics of each phase (the rise, the top and the decline) in detail. Let’s list a few for “the top” and “the decline”:

THE TOP

People get rich & powerful, higher earnings lead to less competitiveness compared to “people in other countries who are willing to work for less”. More money = less work, more leisure. This also leads to people betting on this “good time” to continue and continue to borrow money (financial bubbles).

Other countries copy the methods and technology of the leading power (Chinese products).

Leading country uses reserve currency to continue to borrow excessively = large debt. Leading to the beginning of the currency weakening. “The richer countries get into debt by borrowing from poorer countries that save more- that is one of the earliest signs of a wealth and power shift”.

THE DECLINE

Continual increase of debt leads to economic downturn. The country can’t borrow money to repay debts leading to the decision of either defaulting on debt or printing more money.

The country in question almost always chooses to print more money – gradually at first and then exponentially more leading to devaluation of currency and inflation (ring a bell?).

This devaluation and inflation typically lines up with internal conflict due to race, ethnicity, religion + wealth disparity and differences in values. Leading to “political extremism”, the “anti-capitalist phase” is when the “capitalists, and the elites in general are blamed for problems”.

Heat on the rich comes in the form of higher taxes which leads them to move to “places, assets and currencies they feel safer in”. When this movement of wealth gets exorbitant, it leads to the country outlawing it.

5. CULMINATION

While reading some of this you might have found yourself being alarmed by the extent of the similarities between the text and what is currently unfolding, this is due to the cyclical nature of empires and aggregate human behavior. Dalio consistently publishes his thoughts online and re-assesses where he believes we are in the cycle. He believes we are currently in Stage 5 of “The Internal Peace-War Cycle” (this framework is detailed in Chapter 5 of the book).

Link to Ray Dalio’s recent thoughts: https://www.linkedin.com/pulse/declines-truth-trust-rule-law-have-throughout-history-ray-dalio?utm_source=share&utm_medium=member_ios&utm_campaign=share_via

What that really means is that the US is currently on the precipice of increasing chaos that can lead to greater internal turmoil due to the increase in distrust of the government and politicians. The idea of any form of civil war might sound ludicrous, but I would urge you to think back to all the unprecedented events that have taken place in the past 3 years. As bystanders, all we can do is stay informed and prepare accordingly. Focus on what you can control.

6. MY VIEW

Here are my personal views from this section of the book (Disclaimer: I am not a macro expert). The prospect of the complete dismantlement of the US dollar as a reserve currency would be a catastrophic event. Currently, it is still quite avoidable in the sense of delaying the inevitable. Being positioned in the crypto space would provide a significant benefit whether the current reserve currency comes to be in jeopardy or the money printer is turned on again. We understand this benefit which is why we are here in the first place.

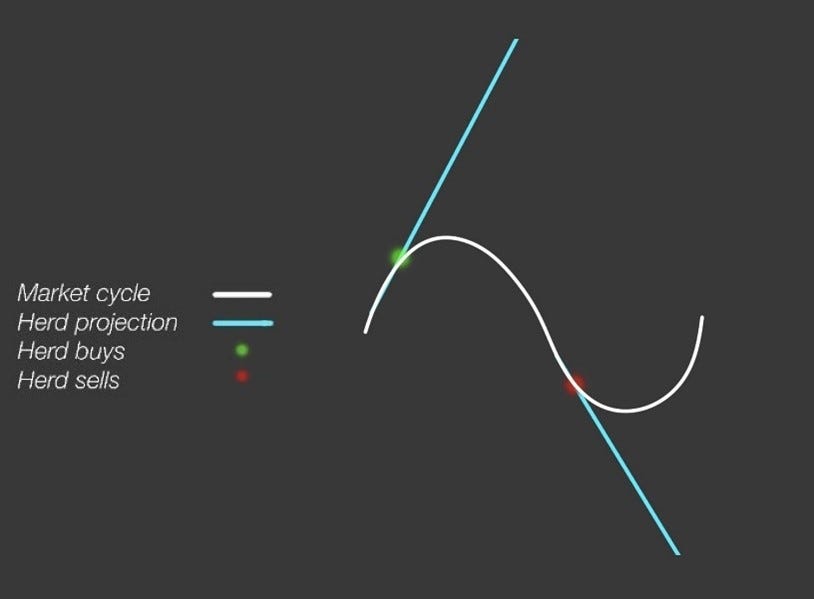

People typically bet on the good and the bad times lingering for a sustained period of time which leads them to contribute to the inevitable reversal. One aspect in terms of the cycle of an empire that is fascinating and can be applied to other cycles (such as crypto) are the factors that are set in place long before the top or the bottom is reached. For example, in the case of a top, individuals will continue to extensively borrow against their money as well as deploying more capital leading to inflation and devaluation of the ecosystem in question.

I would strongly recommend studying cycles, observing aggregate human behavior and reading books such as the one being referenced to have a fundamental understanding of “How the World Works”.

You don’t need to be an aspiring macroeconomics expert to gain valuable insight and to attempt to be two steps ahead of potential outcomes.

Some of the conversations I have with people in this space concern me at times…to say the least. Let’s work on being more informed as market participants.

Hope this was an interesting & insightful read.

Until next time.