This post will cover my insights from “Best Loser Wins” by Tom Hougaard. Unlike other traditional trading books filled with technical analysis, the focal point of this book is an encapsulation of understanding how you deal with loss and the manner in which you manage being in uncomfortable positions.

I would challenge you to completely phase out of internalizing Twitter content and threads claiming “This wallet went from $10 to $10M and how you can too” engagement dumps. In reality, you will lose money plenty of times. Some will lose more than others. The real question is, how will you deal with failure?

The journey will be laced with obstacles. Therefore, it is imperative to understand and dissect how you deal with loss and failure.

“How you feel about failure will to a very large degree define your growth and your life trajectory, in virtually every aspect of your life.”

Tom Hougaard starts the book with a love letter to a personified version of the market:

He stresses the fact that understanding his defense mechanism, how he views failure and his resulting actions is what led to his eventual success in the market.

Interestingly enough, I believe we are at our most vulnerable in the following scenarios: one big win, a streak of wins, one big loss, and a streak of losses.

I learned this lesson the hard way fairly early on. Whenever I managed to secure a big win, it led me to the mentality of pushing the envelope in terms of what I can put on the line i.e. risk management became looser in nature due to the mentality of “playing with profits”.

This led to one relatively larger loss (compared to my usual risk management rules), and then continuing to try to “get even” with the market which led to making more irrational decisions.

This is where the concept of the “best loser” ties in perfectly:

Let’s get one fact out of the way. Trading is extremely difficult. Anyone telling you otherwise is selling you a dream.

Trading is the most difficult endeavor I have ever taken on. There is a steep learning curve and it takes a lot of trial and error to be consistently profitable. To elaborate on this further, I come from a highly technical, mathematics-heavy background and still work on the most complex problems as they pertain to mathematics and engineering on a regular basis. In other words, if it was all just a matter of mathematics and looking at charts, it would be a walk in the park for someone like me.

However, I will admit the way I perceive the market due to my background has given me an edge and made certain aspects intuitive for me. Trading is far from easy. Every position is a battle. But, that’s part of the reason why I enjoy it. It has allowed me to understand myself in many ways. The same point is argued by the author. Trading and the market in general, require much more than throwing lines on a chart.

Tom goes through some anecdotes of his personal trading journey which makes the book an interesting read. However, we will focus on some key insights:

1. “Normal is a Loser”

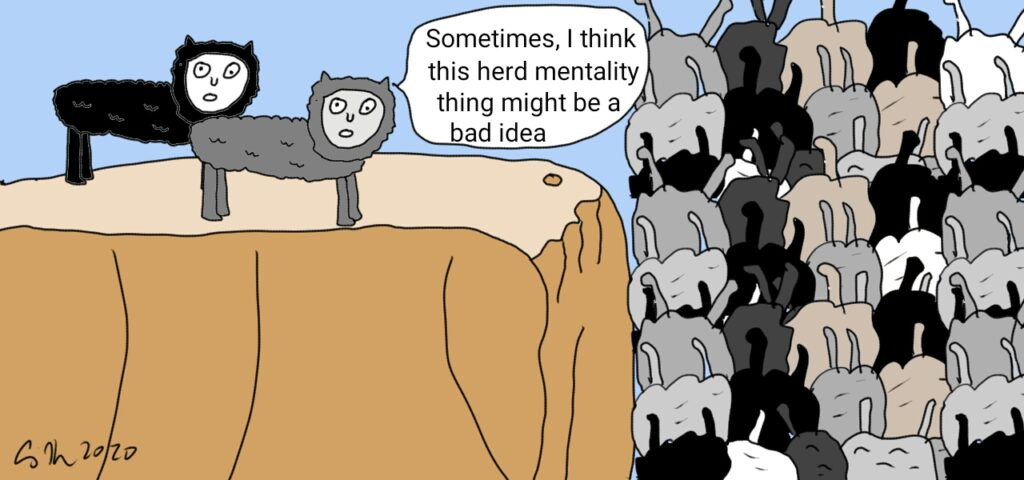

The average person is predictable. Patterns of “thought, action, hopes and dreams, fears and insecurities” are similar when it comes to most “well-adjusted” people in society.

As far as trading is concerned, “everyone who is normal will end up losing”.

Trading data when it comes to failure rate makes the aforementioned statement fairly evident.

If trading was an educational institution, it would have to close the doors and shut down pretty quickly. “No school or university could function if 90% of its students failed their exams.”

Technical tools, theory, and real-time information about the market provide you with data. The use of the data and reactions to the market are based on your interpretation of the data. In other words, if your interpretation or emotional reaction to the data is typical in nature, there is a likely chance that you will not be profitable.

2. Study the 90% and do the Opposite or Replicate what the 10% do.

Tom states that 90% fail because they are unable to “interpret pain messages received automatically from the reptile brain without any modification”.

If you expect to keep doing the same thing with different results, you’re in for a rude awakening. The 10% succeed because they have learned how to “recode” the brain when “pain comes knocking”.

Assuming you are wrong until proven otherwise, shifts the entire perception of how you play in the game of financial speculation. It’s uncomfortable to make this shift because you want to be certain. This shift enables you to think thoroughly about what can go wrong, what the invalidation of the original thesis can look like and to cut your losses rather than adding to losing positions.

3. Make Friends with the State of being Uncomfortable

This is a bit of a philosophical discussion. Think of how you feel when you conquer a challenging task. All challenging tasks are uncomfortable in nature.

The brain can be trained to deal with pressure in a calculated manner. Ideally, you want to win big and lose small. Emotions need to be controlled when facing loss because they will come in abundance.

Hence, the “best loser wins”.

4. The Ideal Mindset

This section of the book is fairly elaborate. Here are a few points that stuck out to me:

Introspection is required to reach a state of mind that is at peace with loss as much as it is at peace with wins.

Our mind is hard-wired for survival i.e. it functions so as to avoid pain. “Association (connecting past moments with the present moment) and pain avoidance do not go hand in hand with trading”. Every moment in the market is unique in nature.

The manner in which you perceive information is to be understood. “Information on its own has no power over us. It is our belief system and the energy we give to the information that decides its potency.” Perceiving information without the hanging cloud of fear is the ideal mindset.

“Randomness is unstructured freedom without responsibility”. Trading and Investing provide unlimited potential for expression. There are no rules, no limits. You can do what you want. In this arena, you must create your own rules. and stick to them. This is what brings out associations made long before you ever enter the arena.

Conclusion

“Best Loser Wins” is about pain, acceptance of pain, and a framework for dealing with failure. It revolves around explaining the importance of being patient and sitting on your hands when necessary, being able to deal with pain in a constructive manner - accepting loss while extracting value from it, and the ability to keep going.

I hope you were able to take away something of value from this summary.

Until next time.

“We are more often frightened than hurt; and we suffer more in imagination than in reality.” – Seneca

This is so good, had to make an account just to comment. Appreciated!

Thank you for sharing this for free!

After a losing trade, my brain tells me to instantly jump back in the markets, because it's still so hard for me accept losses. This helps : )

'The most important thing to do if you find yourself in a hole is to stop digging.' - Warren Buffett